Fintech business lender MarketFinance has stepped in to help SMEs bridge the gap between paying furloughed staff and waiting for their CJRS claim

With almost two-thirds of UK businesses slashing their marketing budgets, these are testing times for the country’s creative, digital, martech and adtech companies – will Government help prove enough for them to survive?

Coronavirus has put paid to many of the industry’s best-laid plans: many had believed that the new decade would mark renewed investment in media and technology with a desire towards more sophisticated and addressable advertising solutions.

Yet marketers have pressed pause, as this week’s Institute of Practitioners in Advertising’s Bellwether report makes clear. Though many are quietly confident that things will bounce back after the long peak of COVID-19, for some – particularly the small and medium enterprises at the heart of next generation solutions – it may come too late.

Furlough pressure

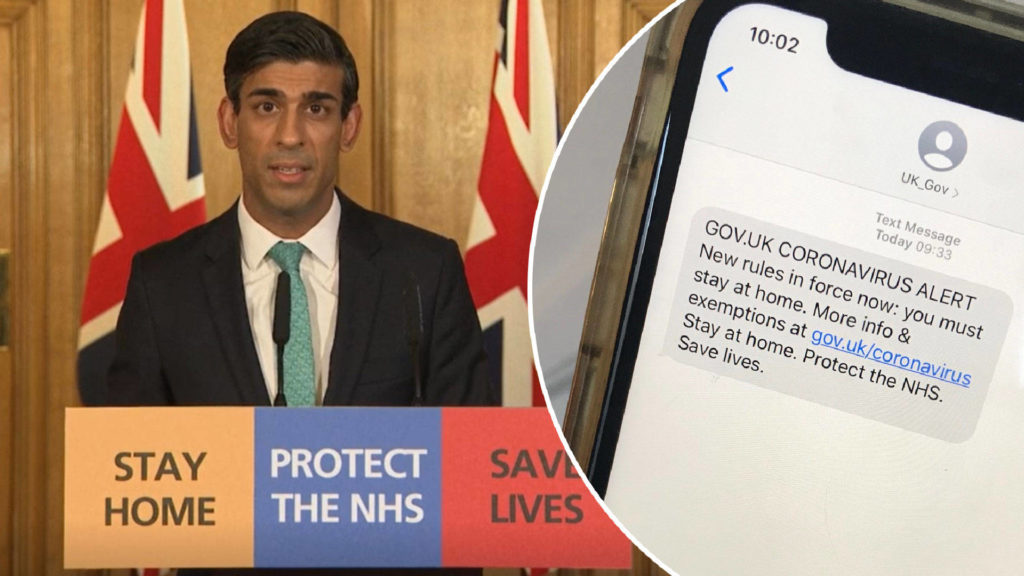

Fintech business lender MarketFinance today [Wednesday] warns that the Government’s Coronavirus Job Retention Scheme (CJRS) will put financial pressure on SMEs as they pay furloughed salaries up front.

Businesses must pay staff and then reclaim the money from HM Revenue and Customs (HMRC) online starting this week (20th April). However, firms are not expected to start receiving rebates until at least the end of April, and maybe even longer.

Furthermore, the government-backed Coranivirus Business Interruption Loan Scheme (CBILS), which offers finance facilities to businesses of up to £5m over six years with the first interest free is not an option to many.

MarketFinance reports that 48% of creative companies are fearful they would not be eligible for the scheme because they have existing business loans and servicing an additional debt would cripple them. Additional concerns over their cash flow and business models mean they are reluctant to apply.

Some 85% of creative agencies report they will run out of money before June 2020 and eight in 10 creative agencies say their revenue has taken a hit because of COVID-19.

It is why MarketFinance, which has delivered invoice finance solutions since 2011, has pivoted its offering, hoping to help those most in need survive during the crisis and thrive thereafter.

Where invoice finance has up until now seen businesses advanced money owed to them in outstanding invoices, MarketFinance will now offer the same cash flow solution to SMEs looking to advance funds owed in CJRS claims. Businesses will initially be able to apply for funding facilities up to £150,000.

Said Anil Stocker, CEO at MarketFinance: “Agency bosses have been hit hard but they need to press on and put measures in place to ensure they survive this crisis. The Coronavirus Job Retention Scheme will help to protect talent but they shouldn’t shy away from the CBILS.

This scheme covers a range of finance options, not just business loans. We found that a third of creative agencies are unaware of invoice finance as means to remedy cash flow problems and three quarters of firms have never used it. Invoice finance is available under CBILS”.

Nick Armitage, Managing Partner at creative agency Nonsense London commented: “A number of our clients have paused projects until there is a little more certainty on what lies ahead with this crisis.

“That said, there is still a huge opportunity for brands to connect with their customers digitally in more personal and creative ways. Everyone is in the same boat so the rules have completely changed. We have to find the advantages and opportunities in this terrible crisis and keep moving.”