NDA Live: A Year in Review, held at London’s Soho Hotel in December in association with MiQ, took a look back at 2024 to learn lessons about what technologies, innovations and marketing approaches will be most important in the year ahead. Read Part One of the event recap here.

The event featured expert industry speakers including Tom Mills, Global Head of Media Development at Haleon; Amy Caven, Head of Media Strategy and Planning at Boots; Kerry Thorpe – Head Of Communications, Ben & Jerry’s; Patrick Zinga, Digital Media, Data & MarTech Lead, Heineken UK; Sandra Hughes. Head of Measurement, Strategy & Propositions, Tesco Media Platform; Ollie Shayer, Omnichannel Marketing Director, Boots; and Mays Elansari, Former Marketing Director at Subway.

Joining the dots in 2024 was vital for Lara Koenig, Global Head of Product, MiQ – the more fractured the media landscape becomes, the more important it is to try and make sense of it so it works for advertisers and the consumer. “We’ve seen some really strong examples in the TV to commerce space, which feels omnichannel by design, and trying to tie that together with some smart measurements.”

While it’s been “a really fun, innovative year”, Koenig admits that “it’s not quite perfect yet”. 2025, it seems, is going to present plenty opportunity to revisit and refine.

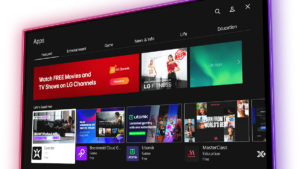

“Video is going to be a huge part of getting better quality eyeballs,” suggests Tom Mills of Haleon. “Linear TV is falling away, offline consumer engagement is merging with online. It’s a patchwork quilt and it’s going to become more complicated for us as the fragmentation grows.”

The lack of a common currency to measure connected TV contributes to the confusion. “It’s improving with attention metrics but it’s a huge opportunity to get right,” Mills adds.

Caven agrees that measurement is the challenge and she’s trying to “find that sweet spot, between SVOD, BVOD and YouTube”, and that attention is again the best possible proxy to measure video at the moment.

Sandra Hughes, Measurement Director at Tesco insists that measurement is something that has been, and will continue to be, a hot topic. “I’ve come in to help take a step back. What do we really need to focus on, what are the key pillars we want to go deeper on. It’s going to be really interesting to see how retail media can branch out into the upper funnel and how we deliver from a brand perspective.”

Trust continues to be an issue in the wild wild west of the world wide web. “People spend most of their digital time on the open web. It’s an important environment to scale and drive performance, but it does come with some risk,” Trott warns. He cites overpaying for tech that doesn’t add anything and ineffective impressions as being two key battlegrounds. For him, this means putting a solid programmatic infrastructure in place and working with best-in-class demand and supply side platforms.

“We’ve put some guardrails around owning our own transparent supply and demand paths, having as much control as possible to make sure we’re getting the best quality impressions possible,” Mills adds, noting that the rush to drive down costs hasn’t really worked out and advising that investing in quality really does pay off.

Learning from mistakes

Of course, not everything has gone entirely to plan in 2024. Failures and challenges are part of the rich media tapestry.

“It’s pivotal to talk about failures because of the learning element,” Zinga insists. He reveals that one particular ‘learning experience’ was Heineken’s ‘Tchin tchin’ app of which he was project manager. Partnerships with Uber were in place, consumer insight gathered, app developers secured and yet it went unused. First, sign on was too long, then the reward offering too confusing. “Six months later, it was defunded and the money moved elsewhere, but we learned a lot about how we operated as a business – and we aren’t an app business.”

Ben & Jerry’s is no stranger to failure. Its ‘flavor graveyard’ is a tourist attraction in Vermont in its own right. “It’s a huge part of our culture,to embrace failure. We leave a certain amount of budget and time to try new things,” Thorpe insists. Even though the Sundaes Festival was a success, some of the merchandise was problematic. “We’d ordered a range of sizes but they stopped quite low. A festival-goer asked if we had a larger size and we didn’t. It was confronting for someone to say “but you’re Ben & Jerry’s? Why wouldn’t you do this?” She says holding their hands up with genuine emotion was important. “Our team admitted they were mortified and said they had their promise this would never happen again.”

For Tesco’s Hughes, it’s not a failure per se, but she’s aware that some processes could be so much better thought out if the supermarket is going to deliver on its data strategy. “Tesco clubcard data accesses 23 million households with 85% of their transactions going through it. When we send back results, there’s a lot of profiling, a lot of that data going back. But everything is going across. It’s not being standardised or consistent. For retail media, we really need to put it in a way that’s going to help the advertiser really pull out the insights.

Haleon’s Mills recognised an ongoing issue in the programmatic space: despite ads passing verification filters for brand safety, fraud, viewability, and location, the quality of content on these sites often fell short. ‘We were operating in less optimal environments. We’ve applied an inclusion list to retail media campaigns which you’d think would put constraints on it, but we’re selling more products off the back of a quality approach. It was a challenge, but it led to success.”

Full-funnel thinking

One of Caven’s biggest challenges hasn’t so much been the tension between traditional and digital, but the different parts of the funnel. Internally, more integration is needed to get a better understanding of how the different parts of the machine are working together. “My team has spent millions of pounds funding demand for Black Friday and upper funnel comms, that has to be complemented by performance marketing channels.”

The infinite opportunity digital presents can sometimes be hard to control but both Mills and Trott can attest to the value when you do try to impose order. “One thing we really wanted to tackle was optimising our portfolio frequency. We have 200 brands and a lot are active at the same time. How do you try to not inflate media because you’ve got a number of brands bidding on similar audiences at a similar time.”

Quality and validation have been core themes across 2024 and will no doubt continue to be a high priority into 2025, but doing it seamlessly across the omnichannel is where the greatest challenge lies. “We’ve always been very integrated but refining and pivoting depending what stage you’re at is fundamental,” Elansari insists. She and Caven both speak to the need for that adaptability to extend to ad creative as well as ad placement – it’s not enough to park a beautiful TV ad online. “You have to develop video content for video platforms for it to resonate with the audience on the right platform at the right time.”

Temptation is a wicked mistress, though, and it seems no-one is immune. “We said yes to too many things,” Elansari admits. “It’s about prioritising, looking at why we’re doing something and looking at the impact.”

The sheer number of things on the to-do list may be why some people drop the ball, or if not drop it then let it bounce a few times more than is optimal before it’s caught. “We’re trying to build products that address global customers, local customers and a wide range of capabilities,” Koenig reveals.