By Ellie Atkinson, Social Strategist at creative agency Digital Natives

Social shopping has become front of mind for the majority of platform users. So much so that our recent research revealed that 49% of people aged 16-54 are more inclined to make a spontaneous purchase via social media than any other channel.

Over the past year we have seen retailers and social channels shifting their approaches, with social channels expanding into e-commerce, and large e-commerce players integrating social approaches.

China’s e-commerce market: a global historic first

In China, e-commerce is predicted to account for more than 50% of their retail sales this year – a global historic first. The country has been storming ahead for the past decade and has already experienced a flip in the market from-bricks-and-mortar to e-commerce, with social commerce one of the biggest contributors to this change.

In fact, social shopping currently makes up 11.6% of retail e-commerce sales, and is set to reach a whopping $363.26 billion by the end of 2021 – ten times more than estimates for the US.

So, what is driving it?

WeChat Mini Programs: the app that does it all

In 2017 WeChat, a Chinese multi-purpose messaging and social media platform, introduced Mini Programs. Built within the WeChat app, they allow brands and companies to develop programs with advanced features without the user being required to download a new app or use more storage.

Valued at over $115 billion, this all-in-one experience has become a cornerstone for many brands in China. And, you guessed it, online shopping is one of the most used Mini Programs. WeChat is so much more than messaging. Product discovery and purchase? Tick. Flag a cab? Tick. Book a medical? Tick. Donate to a charity? You get the idea. It’s not surprising that over 78% of 16–64-year-olds are hooked.

Livestreaming: QVC is back in fashion

Over the last year, livestreaming has started to take shape in the West with Amazon, TikTok and Facebook all trialling new live-shopping features. But, China is on a level of its own. Livestreaming accounts for 10% of all of ecommerce sales, being described by Forbes as the “Home Shopping Network, but with charismatic, trendy anchors”. Just last year, influencer Viya single-handedly sold more than US$4.5 billion through her Taobao live-stream channel.

With Amazon Live, the recent TikTok x Walmart livestream, Instagram’s shoppable Lives and other solutions such as Bambuser coming out of the woodwork, Analysts predict that it won’t be long before social livestreaming becomes a global mainstream marketing tool.

Looking Ahead

Social commerce in China is more than just shopping, it’s entertainment. Combining big-time KOLs, live shopping and messenger has given customers in China the ultimate immersive social shopping experience.

But it doesn’t stop there – AR and VR are taking over with virtual try-ons and shopping trips becoming the norm. Interestingly, this is prevalent within luxury, a category that was previously completely dependent on an intimate VIP in-person experience for customers.

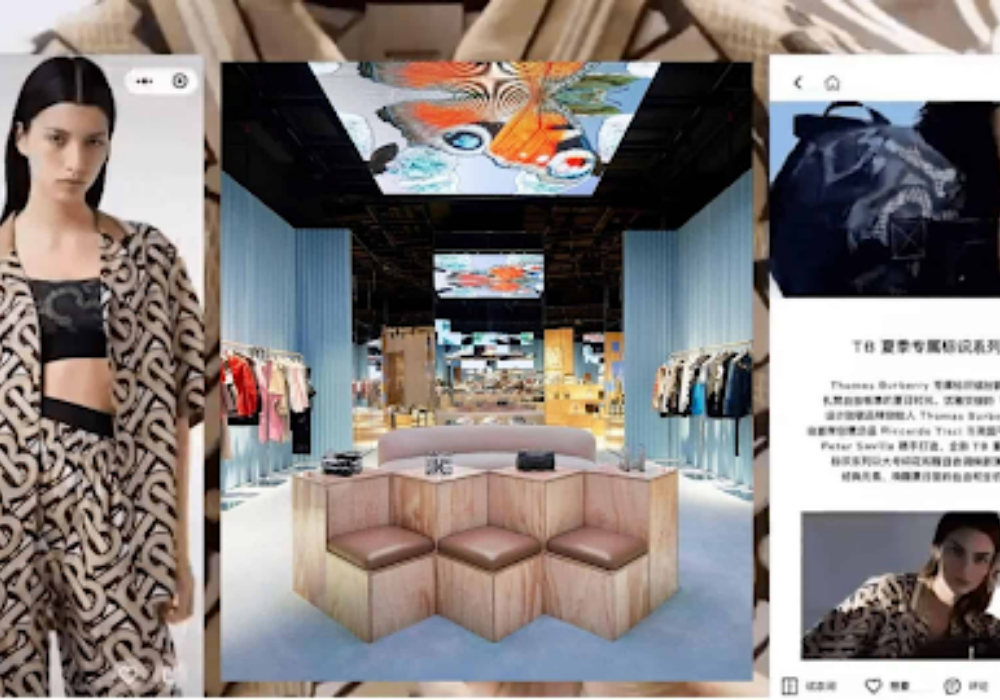

Leading the way: Burberry’s luxury store

Burberry has become the model for in-store brand VR experiences. Its concept store was opened in partnership with WeChat in Shenzhen last year, and shows the incredible potential of virtual reality in retail. The store allowed customers to access content and personalised experiences, all shareable through social media. Burberry created content that customers were able to unlock via WeChat such as events, restaurant reservations. This digital-centric bricks-and-mortar store is not the only one of its kind, other brands have done this too such as Nike.

An Augmented Experience

Fueled by a demand in retail, entertainment, and gaming, the global AR market size is estimated to reach $340.16 billion by 2028, according to a report from Grand View Research, with accessible innovations continuing to emerge. Burberry’s digital-centric store has attracted much attention from the luxury market in China, and according to Content Commerce Insider (CCI), they have hit the nail on the head when it comes to successfully integrating AR and VR into our every-day social commerce market.

CCI believes that the ‘sweet spot’ for AR and VR is integrating these experiences into our phones without the need for further technology. Taking this one step further, not having to download these features with a different app but being able to access them through one cohesive platform, therefore creating the least resistance, is the aim.

The Drum Labs’s CornerShop

One example of such AR-integrated experiences is The Drum’s CornerShop, an IRL store with AR at its core. Visitors set up their phones upon arrival, which then act as a remote control to the store where they can interact with custom interfaces such as a future of coffee concept, a virtual try-on mirror and automatic check-out. Whilst this level of AR integration is far from mainstream, bringing retail into the social, experiential and entertainment space is the future.