Scaleup accelerator Tech Nation has released the seventh edition of its annual Tech Nation Report, lifting the lid on an extraordinary year for the UK tech industry.

The new report reveals that, despite the pandemic, in 2020, the UK tech scaleup ecosystem continued its strong growth. Valued at $585bn, startups and scaleups more than doubled (120%) their collective value since 2017. In comparison, the next most valuable European scaleup ecosystem, Germany, was valued at $291bn.

Driving UK tech into new heights in 2020 were ten superstar scaleups (including fintech company Revolut, Octopus Energy and transport operator Arrival) which between them secured 20% of total UK tech VC investment, at $3.5bn.

Gerard Grech, Chief Executive, Tech Nation, said: “This year has highlighted the UK tech sector’s enormous resilience and world-beating innovative spirit. In the face of a major global crisis, it has not only survived; in many areas, it has boomed. From EdTech to HealthTech, tech scaleups are at the centre of rebuilding the British economy and setting new standards worldwide.

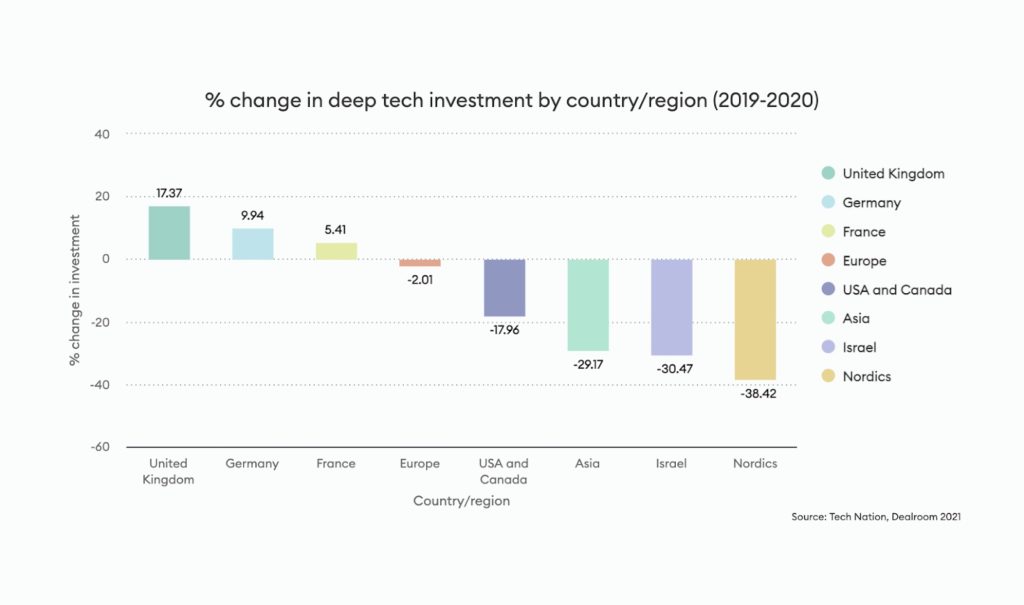

“Developing Britain’s AI-powered deep-tech is especially critical. Much of our future economy will be built on this new technology that leverages machine learning for faster innovation. Bold investment is needed in R&D to boost Britain’s new deep-tech companies and ensure our global competitiveness.”

Despite uncertainty caused by the pandemic, UK Tech IPOs gained strong momentum in 2020, signalling the UK’s attractiveness for tech companies and the continued health of the UK late-stage tech ecosystem. Eight of the UK’s tech companies IPO’d on the LSE in 2020, raising a total of £3.1bn.

When compared with 2018, 2020 had double the amount of capital raised through IPOs. A notable highlight in 2020 was Manchester-HQ’d The Hut Group’s IPO (THG), Europe’s largest-ever eCommerce IPO, which raised £1.9bn at a market capitalisation of £5.4bn.

There was also a record level of VC investment in 2020 into UK tech companies, despite the backdrop of the global pandemic. Investment reached $15bn, $200mn higher than 2019’s record breaking year. Investment gained momentum throughout 2020, reaching a peak in December 2020 at $1.9bn. The UK hubs driving investment were London, Oxford, Bristol, Cambridge and Edinburgh. Data reveals a surprising UK sector champion – transport tech – which had a 160% boom in VC investment in 2020 taking it from $650mn to $1.7bn.

However, the UK is trailing on R&D, with some private overseas companies investing more in R&D than the UK does as a nation. Data from the ONS finds that UK R&D expenditure (public and private spending) was just under £30bn in 2018, whilst in the same year, the combined R&D expenditure of Amazon and Alphabet (on their own R&D activities) was £33bn. Comparing this on the global stage, total US R&D expenditure in 2018 reached $551bn, while China’s R&D expenditure reached $463bn.