ScreenThink, MTM’s market intelligence insights tool for the TV and video industry, has unveiled the findings of its latest research report which explores the impact of advertising tiers on Subscription Video on Demand (SVOD) services. Contrary to initial concerns, the latest data reveals that the introduction of ad tiers has had a surprisingly positive effect on the streaming brands.

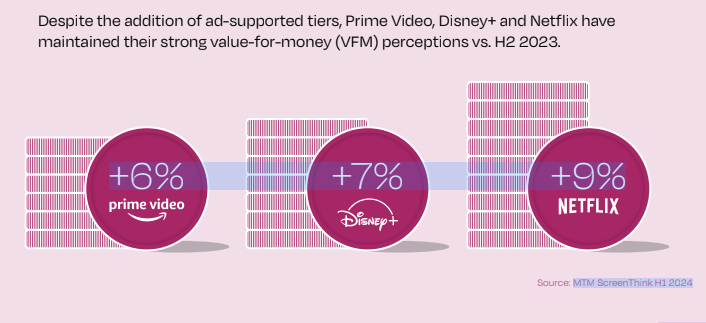

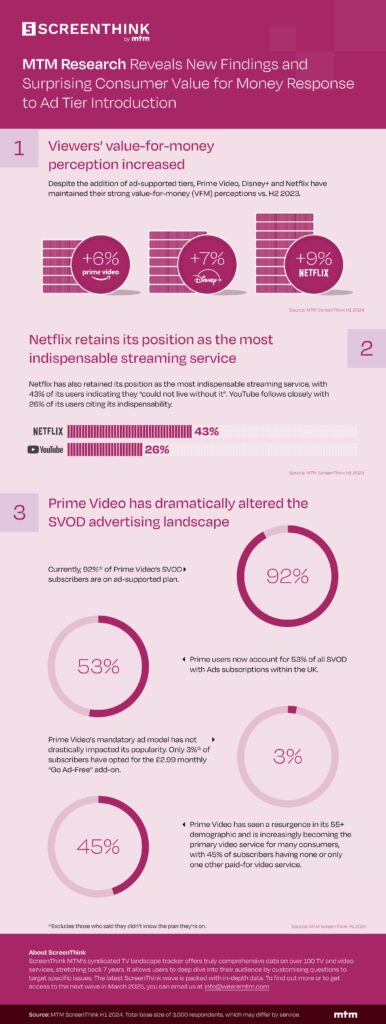

Despite the addition of ad-supported tiers, Prime Video, Disney+ and Netflix have maintained their strong value-for-money (VFM) perceptions. The data from ScreenThink shows viewers’ value-for-money perception increased by 6% for Prime Video, 7% for Disney+ and 9% for Netflix. On top of that, Netflix has also retained its position as the most indispensable streaming service, with 43% of its viewers indicating they “could not live without it”. YouTube follows closely with 26% of its users citing its indispensability.

Prime Video’s decision to make ads mandatory for its paid plans (unless users opt out) has dramatically altered the SVOD advertising landscape. Currently, 92% of Prime Video’s SVOD subscribers are on ad-supported plans, which means thatPrime Video holds 53% of all ad tier subscriptions within the UK’s SVOD market. This approach contrasts with Netflix and Disney+, which offer ad-supported tiers as a more affordable ‘opt-in’ alternative.

Prime Video’s mandatory ad model has not drastically impacted its popularity. Only 3% of subscribers have opted for the £2.99 monthly “Go Ad-Free” add-on, indicating that the majority are either accepting of (or unaware of) the option to remove ads. In fact, Prime Video has seen a resurgence in its 55+ year old demographic and is increasingly becoming the primary SVODfor many consumers, with 45% of subscribers having no other, or only one other, paid-for video service.

However, although Prime Video has achieved considerable reach with its ads, this doesn’t necessarily translate into significant revenue gain. Currently, the ad load is less than broadcaster VOD and many of the ads were promotions for other Prime Video content when first launched, although they have introduced non-endemic brands more recently, highlighting the challenges of entering the well-established TV ad sales market.

“The latest findings from our research reveal an intriguing shift in the streaming landscape,” said Philippe Epailly of ScreenThink by MTM. “Despite initial scepticism, the introduction of ad-tiers has proven to be a positive development for major streaming platforms like Prime Video, Disney+ and Netflix. Our data shows that these services have not only maintained their strong value-for-money perceptions, but have also adapted remarkably well to the changing market dynamics.

Philippe Epailly from MTM adds: “The fact that Prime Video’s mandatory ad model has been met with minimal rejectionfrom its customers suggests that consumers are becoming more accepting of SVOD ads or may not be fully aware of their presence. Our research highlights how well these services are navigating the challenges of the ad-supported model, and we anticipate that this adaptability will play a key role in shaping the future of streaming.”