UK ad spend reached record levels of £31.9 billion in 2021, as the rising cost of advertising and higher-than-expected growth in key areas of online advertising drove growth of £8 billion above original forecasts. The latest Advertising Association/WARC Expenditure Report shows that the UK ad market grew by 34.3% year-on-year.

Interestingly, three in every four of those pounds spent on advertising now goes into the online world, putting the UK on par with only China in that respect. Internet ad spend reached £23.5 billion in 2021, representing 73.5% of total UK ad spend, and a leap of 11.7 percentage points from the pre-pandemic levels figures in 2019.

Search – including ecommerce – was the strongest performer in 2021, growing to £11.7 billion and beating its April 2020 projection by over £3.7 billion. Social media, online video, and TV all also considerably exceeded expectations.

“The Covid-19 recovery last year was buoyed in part by the release of pent-up investment on established online platforms – as well as maturing ones such as TikTok – and in part by the emergence of retail media as a major contender for marketing budgets. The latter trend bears the hallmark of a new era in advertising, one which is set to fuel growth over the forecast period and beyond,” said James McDonald, Director of Data, Intelligence & Forecasting at WARC.

As a result of the record-breaking year, the AA/WARC report has upgraded its previous forecasts for 2022. The UK ad market is now predicted to grow by 10.7% to reach £35.3 billion, thanks to higher CPMs and increased demand ahead of the FIFA World Cup at the end of the year. In 2023, we can expect an additional 5.4% to be added to the market, reaching £37.2 billion, but the report warns that this could change due to the effects of the cost-of-living crisis and supply chain disruption.

“The UK has held its position in 2021 as the largest advertising market in Europe through the pandemic and is now the third largest in the world, behind the USA and China. While further growth is forecast, inflationary pressures on the cost of advertising, and more generally, due to the ongoing geo-political uncertainties, mean we should be cautious,” said Stephen Woodford, Chief Executive at Advertising Association.

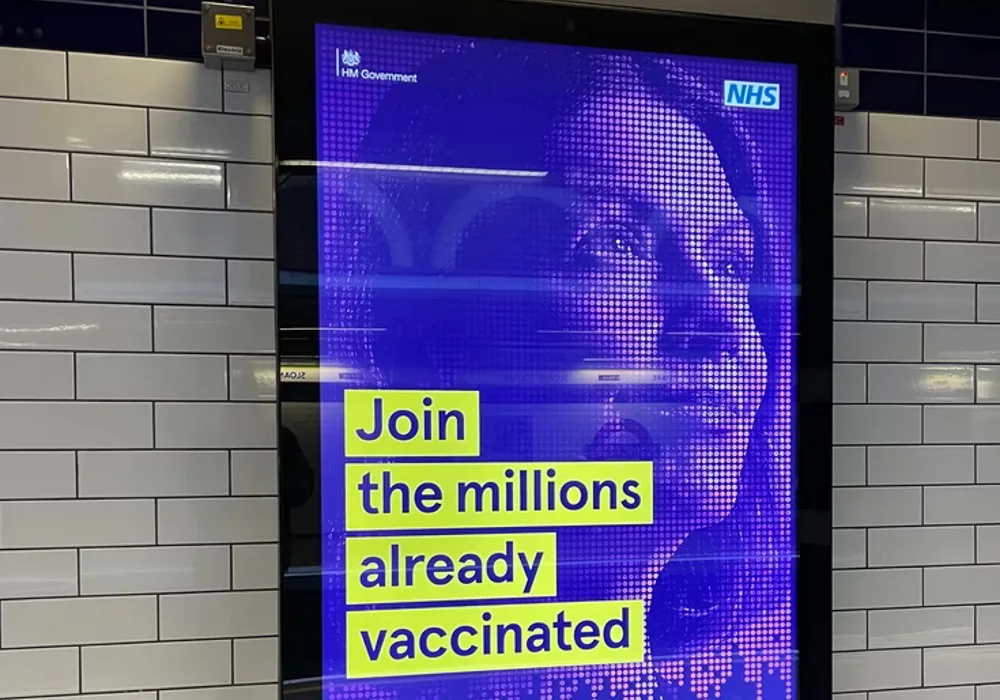

“While lockdowns saw sharp declines in spend across some sectors, the pandemic presented our industry with opportunities to innovate and meet the public health challenges. The UK Government remained in pole position as the largest advertiser. Cover wraps in our print media informed the nation with ‘Stay Home’ public health messages; direct mail brought testing kits and essential deliveries to households up and down the country; and billboards showed the everyday heroes in our NHS.

“Such innovation, creativity and responsiveness will be critical in the years going forward, as we build a sustainable future for our industry, and help businesses, large and small, build relationships with their customers.”