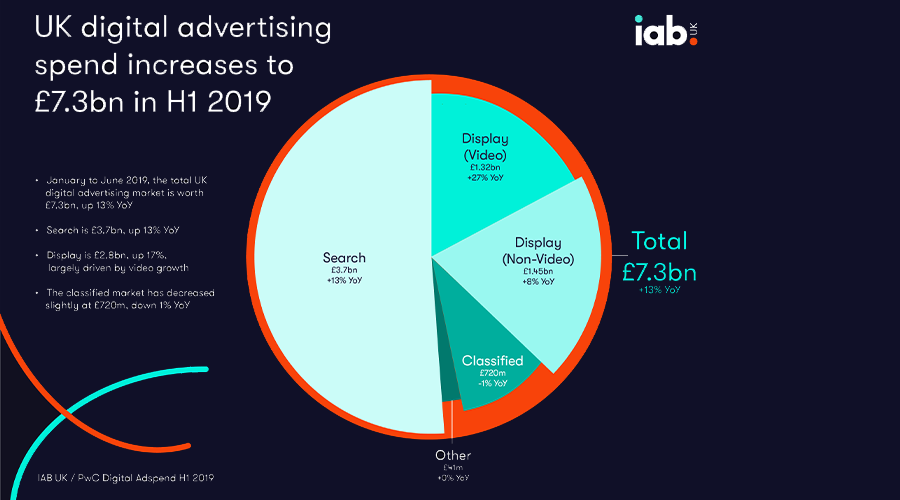

The IAB today announced that total UK digital ad spend was up 13% year on year in the first six months of 2019.

NDA has been hearing the digital industry’s reaction to the news.

Gavin Stirrat, VP of Partner Services at OpenX

Today’s news that total UK digital ad spend is up 13% year-on-year in the first half of 2019 proves that digital advertising continues to be a significant — and growing — proportion of advertiser budgets. Display, in particular, is proving resilient, with growth of 8%. But as consumer attention continues to be diluted across platforms, screens, and channels, it’s more important now than ever for advertisers to make smart targeting decisions based on how their audiences are behaving online.

With £1.32 billion being spent on video last year, it’s crucial that advertisers recognise its rising relevance. Our research, in partnership with The Harris Poll, shows that almost a third of UK consumers (31%) watch video clips on their computer or mobile every day, with this surging to over half (52%) for millennials.

It’s clear that there’s an appetite for video content among consumers today: when asked their thoughts on the format, 30% agreed that video ads playing before content they were watching were the most memorable.

While the rise in overall spending is great to see, that increased interest in video spend shows that brands and advertisers are observing changing consumer habits. However, this can’t be a one-off approach to spending and it can’t be limited to video only.

In order to stay ahead in an increasingly competitive market, advertisers need to move away from a one-size-fits-all strategy, and make sure they put audiences front and centre in every spending decision to keep targeting relevant and effective.”

Mike Klinkhammer, Director of Advertising Sales EU, eBay

It’s unsurprising — and yet still positive — to see the latest ad spend figures from the IAB report continued confidence in both Display and Search, the cornerstones of digital advertising.

Looking ahead, aside from the political climate, many digital marketers are concerned about the looming threat of cookie-less advertising, and how this will impact the way we deliver relevant ads in the future. Wherever possible, brands and publishers should be looking to harness the first party data at their finger-tips, and explore how they can cut and slice it in smarter ways — in order to deliver relevant, intelligent advertising, without the need for cookies.

Marketers don’t need to look very far to find cookie-less targeting methods either. Contextual targeting — combined with search and display advertising — is still an incredibly valuable way to reach audiences.

At eBay, as part of our cookie-less targeting offer, we’re turbo-charging contextual targeting by tying it in with new shopper intent capabilities: blending real-time contextual segments with key shopper intent signals — and powered by search algorithms. Contextual may have been simple in the past, but it’s getting increasingly intelligent — and offers a brilliant opportunity for marketers to get closer to their customers.

Anna Forbes, UK General Manager, The Trade Desk

The continued increase in digital ad spend is testament to sterling progress within our industry. The innovations of the past 12 months alone have made it easier — and more rewarding — than ever for advertisers to shift spend to digital platforms.

Most notable is the sizeable growth of video, which contributed well over £1 billion in the first six months of the year. Advertisers have long known that video is a powerful format to reach consumers — but, thanks to the injection of programmatic technology, the power of video as a channel has grown exponentially.

What’s more, this is just the beginning — the contribution of video will likely continue to skyrocket as more and more Connected TV streaming services enter the UK market. And with UK consumers creeping ever closer to subscription fee saturation, advertising will be a key asset in unlocking new revenue for many streaming companies, further boosting an already flourishing sector of UK ad spend.”