New analysis shows that investment in brand building led to a record ecommerce return during peak season, as digital marketing strategies on Meta have become more sophisticated and effective.

Nest Commerce’s latest Readout report is based on the global performance of more than 40 ecommerce brands, 76% prospecting campaigns and 2.3 billion impressions on Meta for Q4.

Bolstered by Meta making significant improvements to its algorithm, Return on Ad Spend (ROAS) increased by a remarkable 35% between October and November for brands investing in full-funnel strategies. Full-funnel refers to long-term investment in brand awareness to generate future demand among new customers alongside driving immediate sales. This compares to an increase of just 2% for brands focused on performance only.

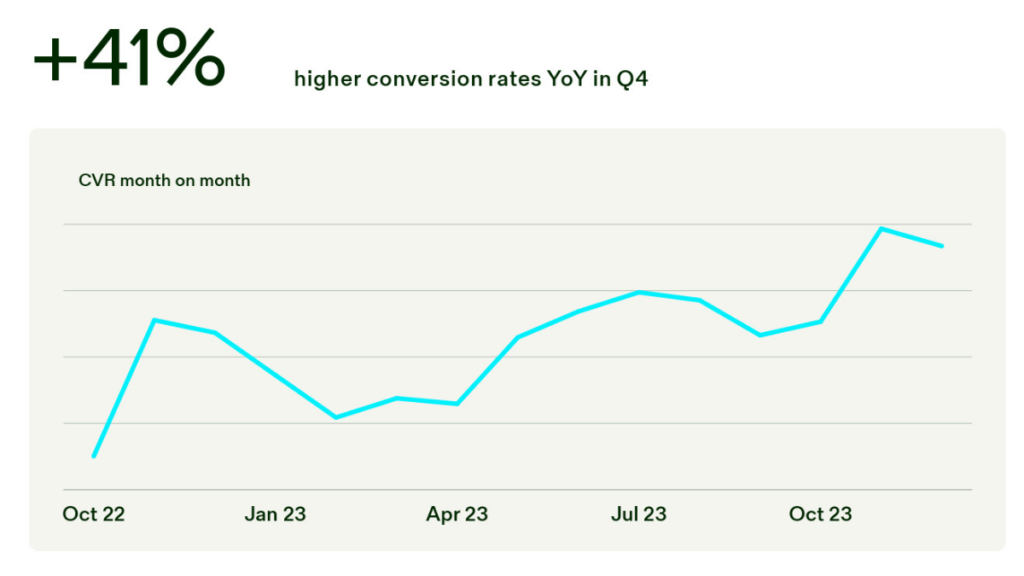

The report found conversion rates were particularly strong throughout Q4, and were 41% higher YoY, now paying off for brands that have the right approach. Conversion Rate (CVR) was 28% higher, while over Black Friday Cyber Monday (BFCM) weekend, there was a 14% YoY boost, with more consumers waiting until deals arrived to make purchases.

Brands target more intentional consumer mindset

With a new more intentional consumer mindset, Q4 is now far more important for brands. CPM spiked by more than expected, a 43% QoQ increase, compared to just 6% QoQ in Q4 2022. Smart brands held back on sales-focused ads understanding the right time to act to convert interest to action.

Conversion rates improved by 52% YoY for Black Friday Sales ads for brands who invested in brand building compared to just 25% YoY for brands running performance-only campaigns. After building awareness throughout the year, these brands were able to cash in during Q4.

Overall investment in awareness and traffic activity increased YoY by 800% and 49% respectively, as brands move budgets towards driving long-term growth and incrementality.

Reels outperforms TikTok

Supporting sophisticated full-funnel strategies on Meta was the performance of Reels. Click-through rates are up by 71% YoY, while conversions have improved by 45% YoY.

Reels is now powering ahead of TikTok in terms of performance. Conversion rates on both Reels and TikTok are high, but increased adoption means that Reels now has a 39% higher CVR than TikTok ads. This positive performance is likely to continue as adoption grows and younger demographics continue to favour short-form video.

Growing opportunity for brands scaling in the USA

The Readout report also highlights the growing opportunity for brands scaling in the US. Poor growth in the UK, as well as challenges in big EU economies like Germany and the Netherlands, make the US more attractive. According to aggregated Nest data, Meta AOV was 158% higher in the US in 2023 compared to the UK.

The report has detailed advice for brands scaling in the US ecommerce market. Nest has successfully supported brands including fashion retailers Nadine Marebi and ME+EM, and equestrian brand LeMieux, scale rapidly in the US with sophisticated paid social strategies.

According to Will Ashton, CEO of Nest Commerce: “In a challenging ecommerce landscape, Nest Commerce’s Q4 Readout report highlights the crucial role of digital brand-building strategies. Those that have invested in full-funnel approaches have reaped the benefits, with a remarkable 35% ROAS increase on Meta, signalling a shift towards long-term growth and improvements in performance on the platform.”

He continued: “Q4 proved pivotal in the battle for market share, with those that invested in brand building seeing a 52% YoY boost in conversion rates. The ascent of Reels over TikTok emphasises the need to adapt to evolving platforms for enhanced performance in the competitive digital market.”