By Shumel Lais, Founder & CEO, Appsumer

This year mobile app advertising has been facing up to the delayed impact of Apple’s privacy changes. Where web advertising went through Intelligent Tracking Prevention (ITP) and the limiting of third-party cookies in Safari several years ago, mobile app advertising is now navigating the challenges of Apple’s iOS14.5 and its IDFA restrictions.

Much like a third-party cookie, IDFAs are used to track users across mobile apps and websites on Apple devices. IDFAs are then used to power activity such as behavioural targeting, retargeting, view-through attribution and connecting advertising campaigns to post-install behaviour. Apple’s upcoming App Tracking Transparency (ATT) policy will require app publishers to request permission to use app-collected data for tracking and accessing device identifiers, including IDFAs. Currently, about 70% of iOS users share their IDFA with app publishers, after this change it’s estimated that this number will drop to 10% to 15%.

So, with iOS 14.5 predicted to come into operation by the end of April, how can mobile app advertising evolve to overcome these new challenges?

Measurement Headaches

With iOS14.5, app advertisers are losing the ability to tie an app user’s post-install behaviour back to every pound spent on a campaign. And more often than not, Lifetime Value (LTV) post-install is a key metric to scale mobile apps, meaning this is a big challenge.

As a result, Apple’s SKAdNetwork (SKAN) attribution solution is fast becoming the de facto solution and the conversion value part of this helps connect campaign spend to some post-install behaviour and user value. However, the solution is limited and iOS14.5 delays have been regular with many questioning if SKAdNetwork even works.

Perhaps the biggest challenge with SKAdNetwork is that often an advertiser will only receive one day of post-install activity for a user. For most this isn’t enough to accurately predict the LTV of that user to measure a campaign’s effectiveness.

One solution for app advertisers to get a fuller picture of LTV will be probabilistic attribution. This is the process of algorithmically assigning campaign membership probabilities to a user based on the attributes and behaviour of that user. But unless a user shares their IDFA on iOS14.5, a 100% probability that a specific campaign drove an install cannot be established. To combat this, SKAdNetwork data, opted-in attribution data, anonymous in-app data and ad network reported data are modelled to assign a probability that a user came from a specific campaign.

But whilst channels such as Facebook and Google will be modelling conversions to fill the gap, advertisers don’t want to let the student mark their own homework. This has resulted in a new category emerging on the vendor side to provide unbiased probabilistic attribution.

That said, some advertisers will also go back to the future and look to use incrementality measurement and media mix modelling to predict LTV of campaigns. Indeed, this method has the added benefit of overcoming some of the losses around view-through attribution.

Media Mix Shifts

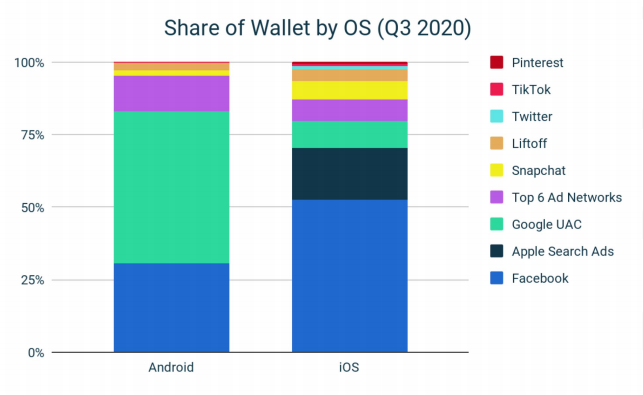

iOS14.5 is likely to drive shifts in the media mix of mobile app advertisers. In fact, our last snapshot of the Share of Wallet for mobile app advertisers found that Facebook has the most to lose from iOS 14.5.

It’s therefore not surprising to see Facebook’s coordinated PR attack on Apple given the social media giant’s success in mobile app advertising is in part down to its ability to accurately target high-value potential users for an app.

In contrast, Apple Search Ads will be largely unaffected by the shift and could see a growth in Share of Wallet off the back of its ATT changes as app advertisers look to the security of investing in known outcomes. There are also murmurs that we could see a broader ad network offering from Apple as they start to make bigger bets on advertising.

For Google Universal App Campaigns (UAC) iOS is unsurprisingly a less dominant channel and while they have announced changes to deal with iOS14.5 it’s not a meaningful part of their significant ad revenue.

What will be interesting, however, is how the challenger channels, like TikTok and Snapchat, who are only just starting to show returns for app advertisers, are impacted. Both these channels rely more on iOS than Android for ad revenue and won’t want their growth stunted by iOS14.5. But with less developed ad offerings they may be able to react quicker to the change and continue to deliver value for app advertisers whilst making further gains. Equally, they could get stopped in their tracks.

In the early days of ATT, app advertisers are likely to tread with caution on iOS. Indeed budgets could shift to Apple Search Ads and Android devices in the short-term for the security of known outcomes. And as the algorithms of channels like Facebook learn about this new world we’d expect the walled gardens to grasp how to use their first-party data to deliver new ad offerings; this will be when iOS budgets may return. There’s also space, like there was with ITP, for new contextual ad offerings to make significant gains post-iOS14.5. But like ITP, complexity around measurement and data will also increase with more sources, new channels and ad models.

In short, app advertisers need to get their heads around this data fast, learning quickly and not wasting energy on exploiting short-term loopholes. These will be the characteristics of those app advertisers that come out on top. Game on.

*Appsumer is a client of Bluestripe Communications, owned by Bluestripe Group, the owner of NDA.