UK media inflation is predicted to reach 3.8% in 2023, down from 4.0% in 2022, according to the ECI Media Management’s 2023 Media Inflation Report, which has just been released.

Across the UK, TV inflation continues to fall, predicted to reach 9.7% in 2023 compared to 16.7% in 2022. However, it is forecast to remain significantly higher than other media types, including Online Video (predicted to reach 3.5%); Online Display (2.5%), Out of Home (2.6%); Radio (2.5%), Newspapers (-2.4%); and Magazines (-2%).

Local media inflation – UK:

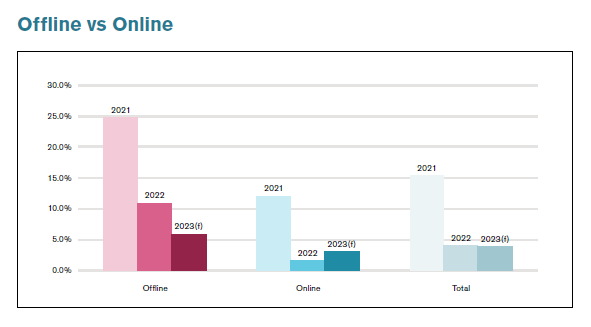

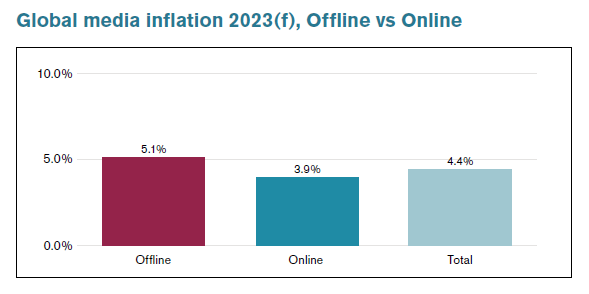

By comparison, global media inflation is predicted to reach 4.4% in 2023, lower than 5.2% last year, with Latin America seeing the highest media inflation at 8.4%, followed by EMEA (4.9%), North America (4.2%) and APAC (4.0%).

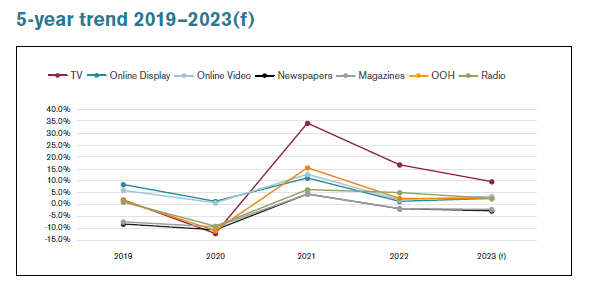

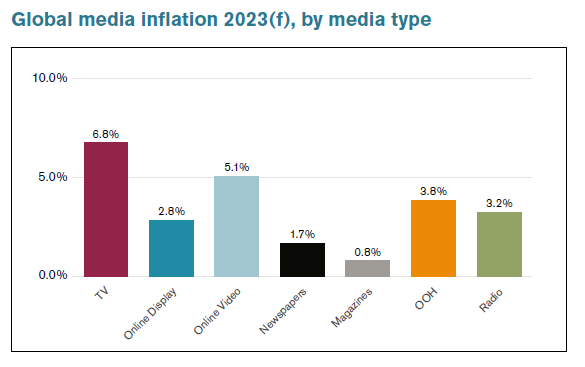

Globally, TV will continue to see the highest inflation at 6.8%, but at its lowest level in the last three years, raising the possibility that global inflation is starting to stagnate. This is likely in part due to fewer major events taking place in 2023, particularly within sports and politics, meaning there will be less demand than in busier years.

Meanwhile, Online Video is forecast to see 5.1% inflation globally, followed by OOH (3.8%), Radio (3.2%), Online Display (2.8%), Newspapers (1.7%) and Magazines (0.8%). This will be the first time in a while that both Newspapers and Magazines look set to inflate.

Global media inflation:

Fredrik Kinge, Global CEO of ECI Media Management, says: “Media prices continue to rise across the world, albeit more steadily than over the last few turbulent years. TV in particular is set to inflate more slowly, raising questions about whether TV pricing is starting to stagnate. This could be driven by advertisers shifting TV budgets into CTV, or by the fact that this will be a quiet year in terms of sport and other major events that drive eyeballs to TV.

“With a global recession seemingly all but inevitable in 2023, this is not an easy context in which to operate for brands, as consumers tighten belts, and energy and supply chain costs continue to rise. However, there is a strong case to resist the impulse to reduce media investment, as well as ample evidence that brands who continue to invest in longer-term brand-building activity enjoy stronger growth during the recovery and beyond. It is therefore more important than ever that media investments are effective; focus, precision and transparency are key.”

ECI Media Management’s annual Media Inflation Report forecasts media inflation for seven key media channels in Q1 each year; TV, Online Display, Online Video, Newspapers, Magazines, OOH and Radio, at a global and regional level, and across 48 countries. An update to these forecasts is now published quarterly. ECI Media Management’s experts have been tracking media inflation since 2012, providing unrivalled understanding of trends over time. Their information is derived from a number of sources, including their global network of experts, real client data and media agencies. It is cross-referenced with industry bodies and publications, as well as with agency traders and media vendors, so it reflects the expertise of those with an impact on trading variables.